Missed the deadline? E-File Form 2290 now to and get your stamped Schedule 1 to reduce IRS penalties.

E-file NowE-file IRS Form 2290 Amendments

Use TaxZerone to Amend Form 2290 Online for Weight Increases, Mileage Exceeds,

VIN Changes, and Get Your Schedule 1 in Minutes.

TaxZerone makes it easy to e-file

amendments for Form 2290

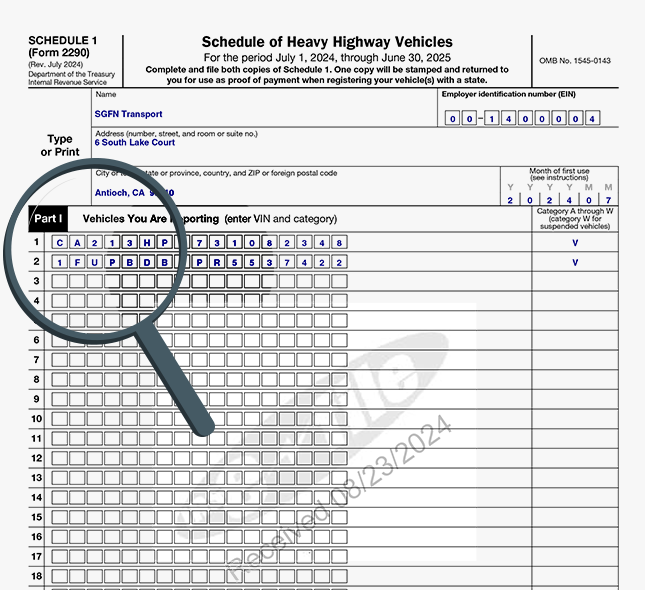

FREE VIN Correction

Correct your 2290 VIN errors for FREE and get your updated IRS-approved Schedule 1

Mileage Exceeded

If your vehicle has exceeded the 5,000-mile limit, amend your Form 2290 to stay compliant and avoid IRS penalties.

How to amend Form 2290 for mileage exceed?

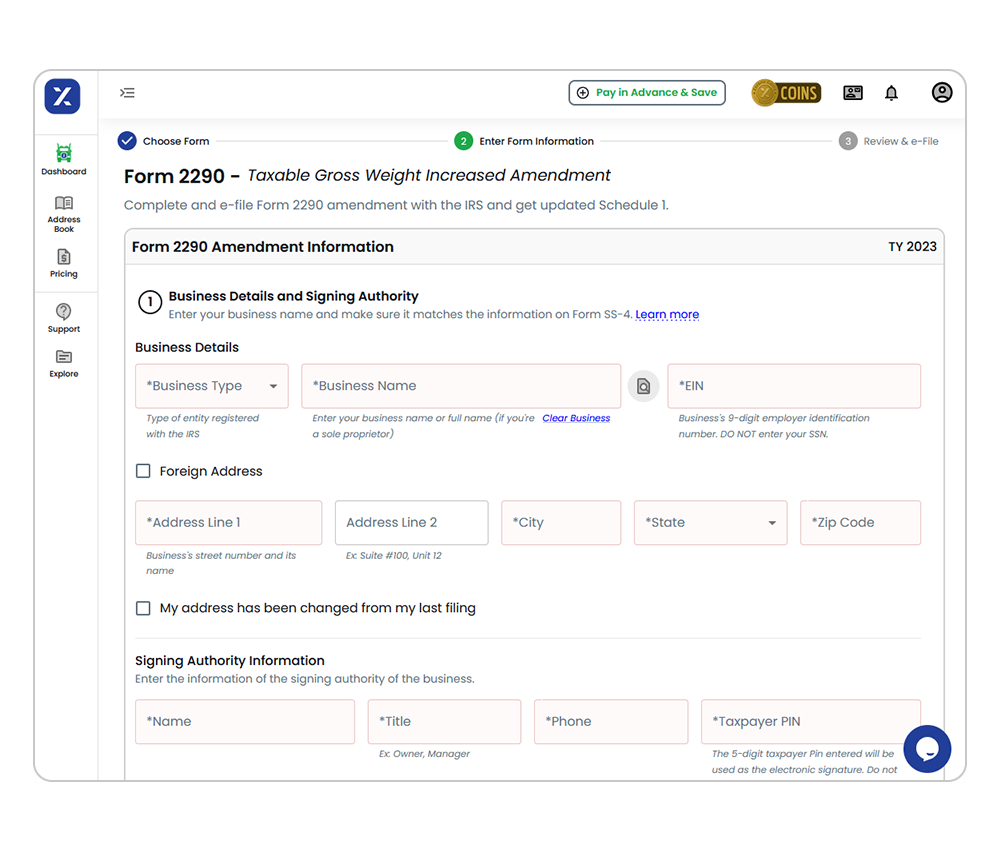

Taxable gross weight increased

If your vehicle's taxable gross weight has increased, confirm accurate HVUT reporting by amending Form 2290.

How to E-File Form 2290 for Weight Increase?

Why Choose TaxZerone?

TaxZerone makes it easy for trucking businesses to file Form 2290 online.

FREE Account

Sign up & Sign In for FREE

10,000+

Truckers trust TaxZerone

Cost Effective

Best Price In The Industry

IRS Stamped Schedule 1

Get IRS Approved Stamped Schedule 1 in just minutes

E-file VIN Correction for FREE

Fix your VIN errors at no charge with TaxZerone. Our user-friendly platform makes it easy to update any incorrect Vehicle Identification Numbers (VINs) for FREE.

Enjoy the benefits of accurate filing and avoid penalties by ensuring your records are accurate. Trust TaxZerone for a fast and FREE VIN correction solution

No Payment Required

E-file Amendment for Form 2290: Mileage Exceeded

Has your suspended vehicle Exceeded the mileage limit of 5,000 miles?

File Form 2290 amendments with TaxZerone for hassle-free compliance. Our efficient e-filing platform and knowledgeable support team simplify the process, ensure accurate submissions, and help you avoid IRS penalties.

For Just $24.99

E-file Amendment for Form 2290: Taxable gross weight increased

Did the taxable gross weight of your vehicle increase during the tax period?

If you've added equipment or made modifications to your heavy vehicle, its taxable gross weight might have increased. On our platform, you can easily calculate the additional tax and file it effortlessly. Receive your updated Schedule 1 instantly.

For Just $24.99