Missed the deadline? E-File Form 2290 now to and get your stamped Schedule 1 to reduce IRS penalties.

E-file NowE-file IRS Form 8849 Schedule 6 Online

Claim your Excise Tax Refund Easily

E-file IRS Form 8849 Schedule 6 with TaxZerone for a quick and easy excise tax

refund on sold, destroyed, or low-mileage vehicles.

Start for just $29.90

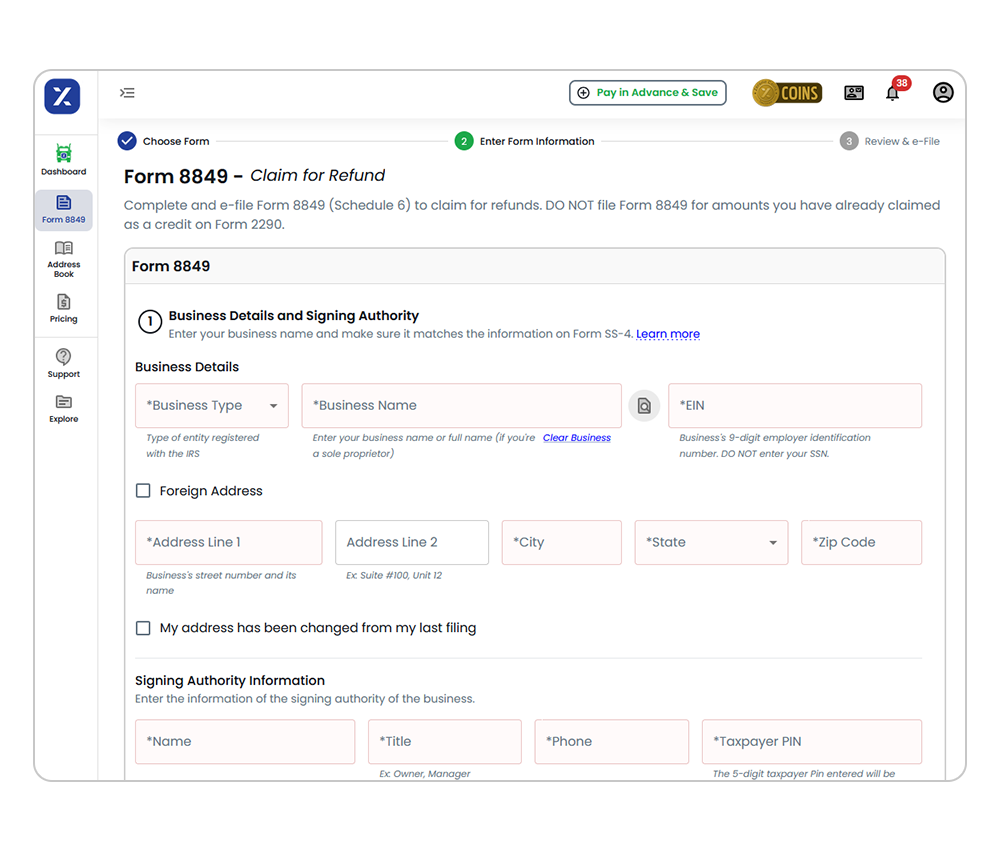

How to E-file your Form 8849 Online Using TaxZerone

Use TaxZerone for a simple 3-step process to file Form 8849 accurately and effortlessly to claim refunds.

Enter Your Business Details

Provide your business information and the end month of your tax year.

Enter Credit Details

Specify details of the truck that was sold, destroyed, or stolen, and if it had low mileage or a tax overpayment.

Transmit to the IRS

Review and send your return to the IRS.

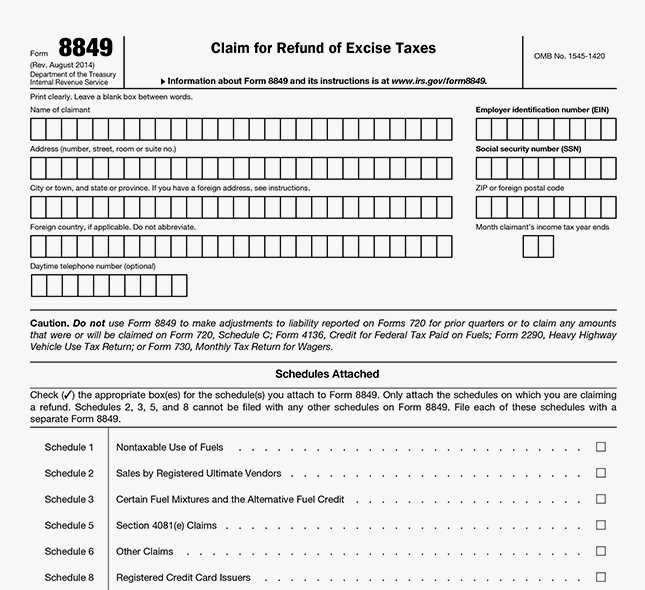

What is Form 8849 Schedule 6?

Form 8849 Schedule 6 claims refunds for excise taxes on heavy highway vehicle use reported on Form 2290. It covers refunds for sold, destroyed, stolen vehicles, low mileage, and overpayments.

File in under 5 minutes.

Form 8849 Schedule 6 Refund Claims Include:

Sold/Destroyed/Stolen Vehicles

Get a refund on excise taxes for vehicles sold, destroyed, or stolen.

Low Mileage Vehicles

Claim a refund if your vehicle was taxed but driven less than 5,000 miles (7,500 miles for agricultural vehicles) per year.

Overpayment of Tax

Claim a refund for tax overpayments made by mistake.

Ready to claim your refund? Use TaxZerone for a quick and easy filing process.

Click to Claim Your RefundEasily claim your trucking tax refund quickly and securely, with the best pricing in the industry

For Just $29.99 only

IRS-Authorized

TaxZerone is an IRS-authorized e-file provider ensuring compliance with IRS regulations.

Multi-Year Filing

Efficiently claim refunds for the last 3 years.

Step-by-Step Guidance

Follow our user-friendly steps to accurately complete and e-file Form 8849 Schedule 6.

Knowledgeable Assistance

Our knowledgeable team is here to help with any questions or concerns you may have while e-filing Form 8849 Schedule 6.

- Live Chat - Chat with us online

- Email - support@taxzerone.com

- Call - (408) 444-7120

Unlimited Filing for Your Fleet

Take advantage of TaxZerone’s unlimited Form 2290 and 8849 filing for your business vehicles in Tax Year 2025.

Our Service includes amendments for weight increases, mileage exceedances, and VIN corrections.

E-FIle Now with TaxZerone!

Customer Reviews!