Missed the deadline? E-File Form 2290 now to and get your stamped Schedule 1 to reduce IRS penalties.

E-file NowForm 2290 for Privately Purchased Vehicle

Privately purchased vehicles are used vehicles bought from a private seller. For Heavy Highway Vehicle Use Tax (HVUT) purposes, if the vehicle is used on public highways for business and has a gross weight of 55,000 pounds or more, it must be reported using Form 2290.

Table of Contents:

Form 2290 Deadline for Privately Purchased Vehicles

The buyer should enter the First Used Month (FUM) as the month after the vehicle is purchased on Form 2290. The due date of Form 2290 remains unchanged.

For example, if you purchased a heavy vehicle from a seller in September, you can set the First Used Month to October, and your Form 2290 would be due by October 31st.

Details to Verify Before Purchasing a Vehicle from a Private Seller?

Before buying a used vehicle from a private seller, verify the Vehicle Identification Number (VIN), title, and ownership. Check if the vehicle was used for logging or agriculture, and review maintenance records. Ensure emission compliance and confirm the seller’s information.

Most importantly, ask for a copy of the seller’s stamped Schedule 1 to confirm that the Form 2290 tax has been paid for the current period.

How to File Form 2290 for a Privately Purchased Vehicle in TaxZerone?

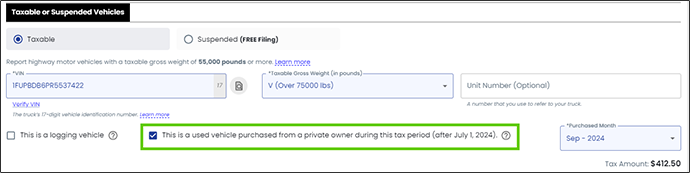

Filing for a privately purchased heavy vehicle is almost identical to filing for a regular one:

- Create an Account: Sign up for an account on the TaxZerone website.

- Enter Business Information: Provide your business details, including your Employer Identification Number (EIN) and business address.

- Vehicle Information: Enter your vehicle's Tax Period, First Used Month, VIN, and weight category.

- IRS Payment: Choose a payment method to pay any applicable taxes.

- Submit: Review & submit the form electronically through TaxZerone. You will receive your IRS-stamped Schedule 1 copy in minutes.

Penalties for Late Filing

- Late Filing Penalty: 4.5% of the total tax due per month, up to 25% over five months.

- Late Payment Penalty: 0.5% of the total tax amount plus 0.54% interest per month.

- Vehicle Registration Suspension: Non-payment or non-filing can lead to suspension of the vehicle's registration.

- State Penalties: Many states suspend registration for vehicles without proof of HVUT payment.

- False or Fraudulent Returns: Additional penalties apply for filing incorrect returns.

Get 10% OFF

Use Code

EFILE2290

to get 10% off and receive your Schedule 1 instantly.

File for Tax Year 2025 now!

File Now & Save 10%